Do you search for 'credit scoring thesis'? Here you can find your answers.

Associate in Nursing accurate and well-performing credit scorecard allows lenders to command their risk pic through the discriminating allocation of quotation based on the statistical analysis of historical customer information. This thesis identifies and investigates A number of circumstantial challenges that come during the developing of credit scorecards.Author: Kenneth KennedyCited by: Publish Year: 2013

Table of contents

- Credit scoring thesis in 2021

- Piecewise logistic regression an application in credit scoring

- Logistic regression credit scoring model in r

- Logistic regression applications in finance

- Google scholar

- Scoring logistic regression

- Logistic regression project report

- Bayesian logistic regression models for credit scoring

Credit scoring thesis in 2021

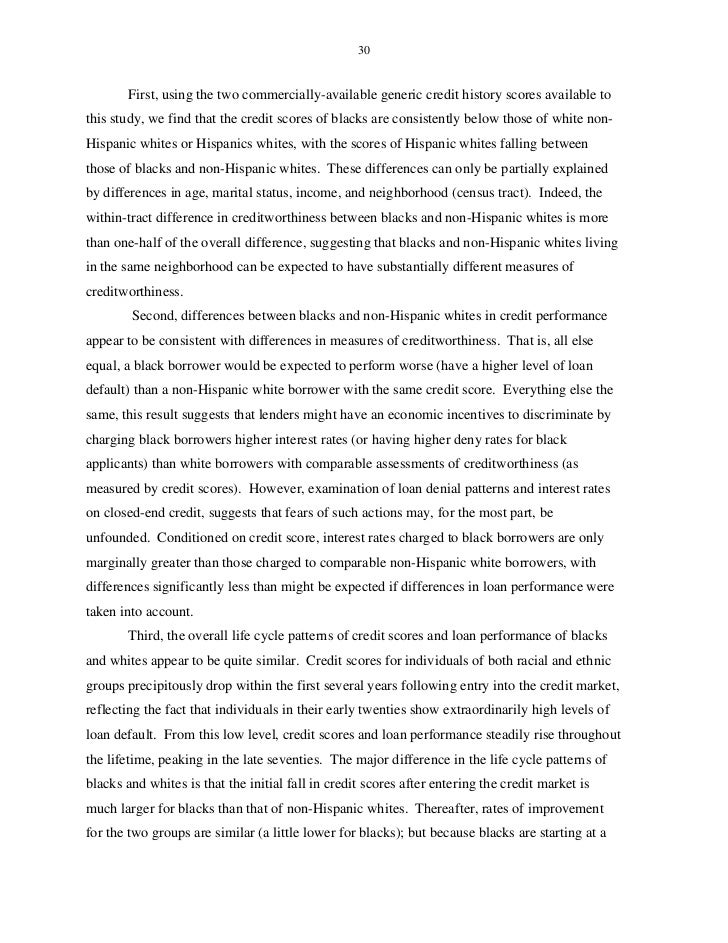

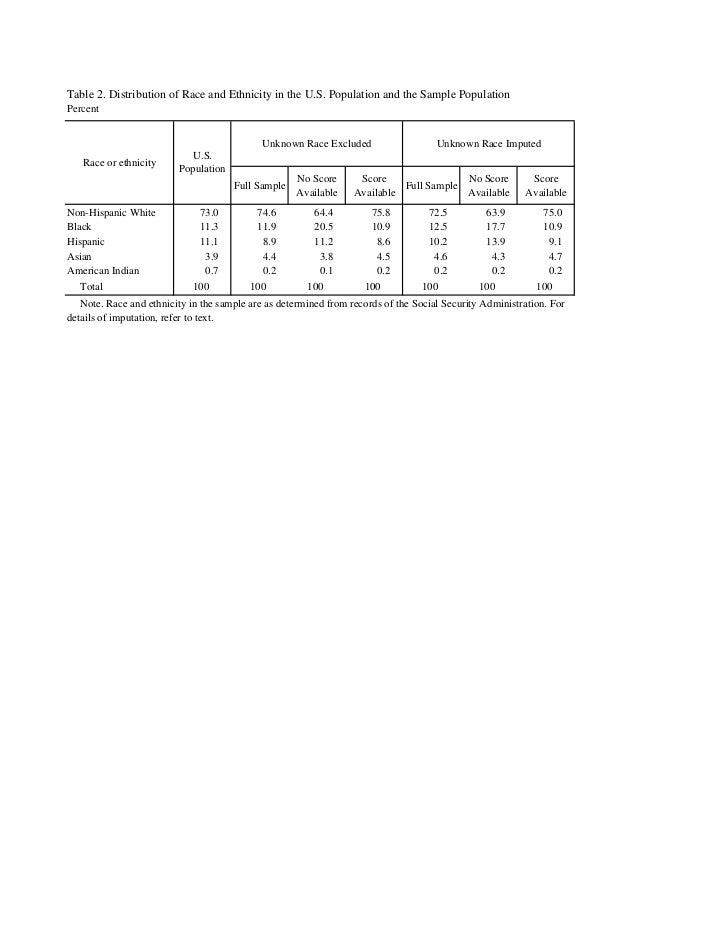

This image representes credit scoring thesis.

This image representes credit scoring thesis.

Piecewise logistic regression an application in credit scoring

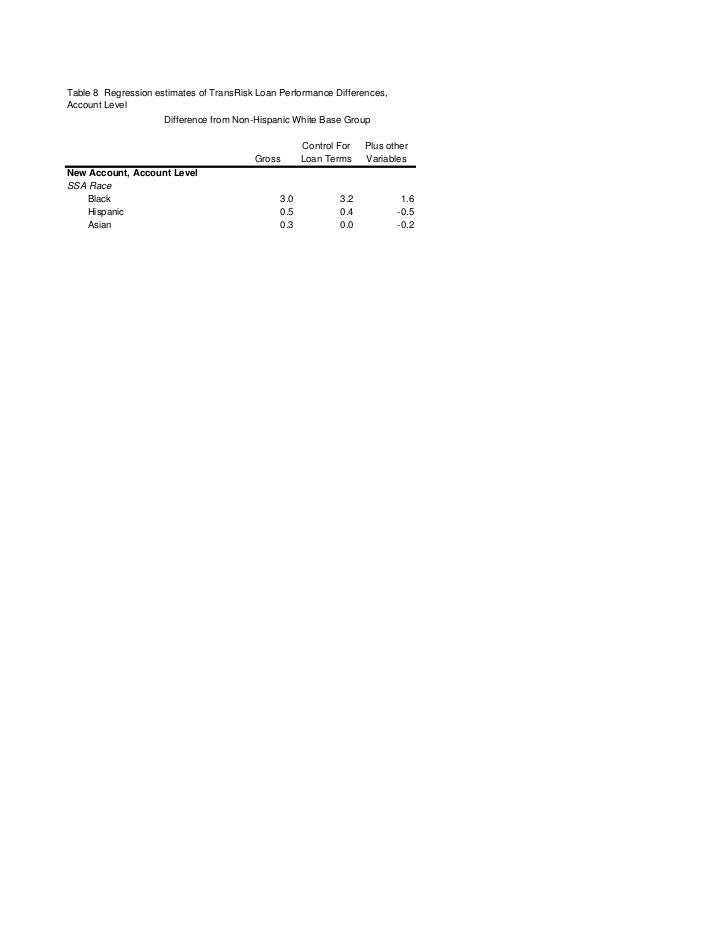

This image demonstrates Piecewise logistic regression an application in credit scoring.

This image demonstrates Piecewise logistic regression an application in credit scoring.

Logistic regression credit scoring model in r

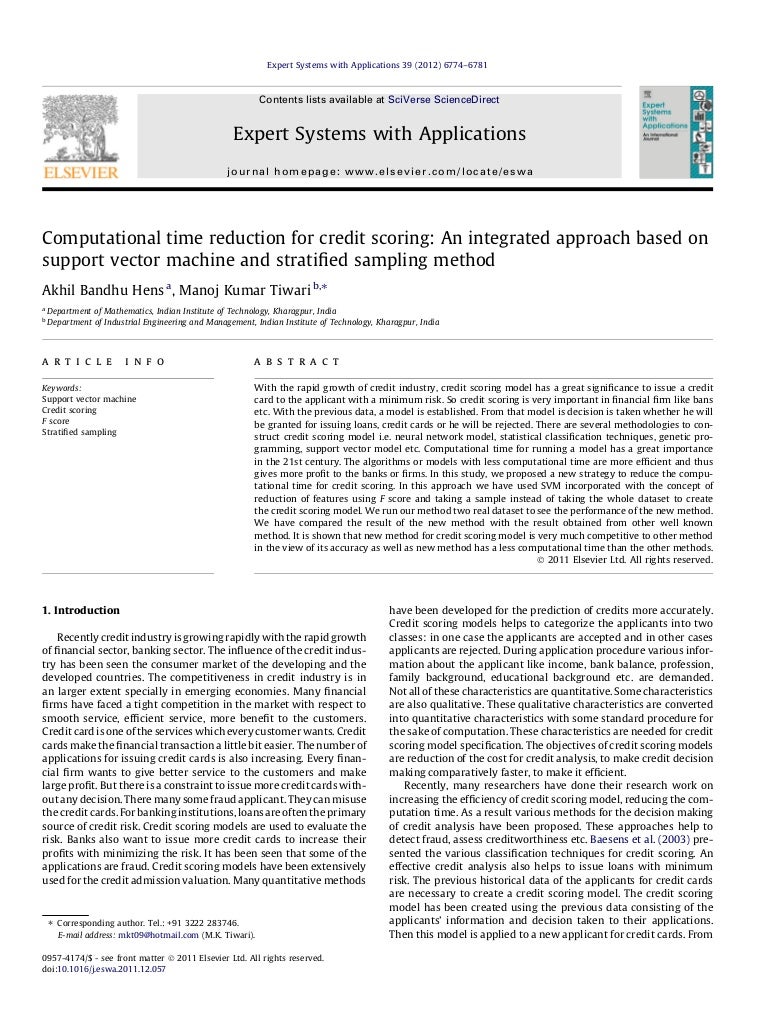

This picture shows Logistic regression credit scoring model in r.

This picture shows Logistic regression credit scoring model in r.

Logistic regression applications in finance

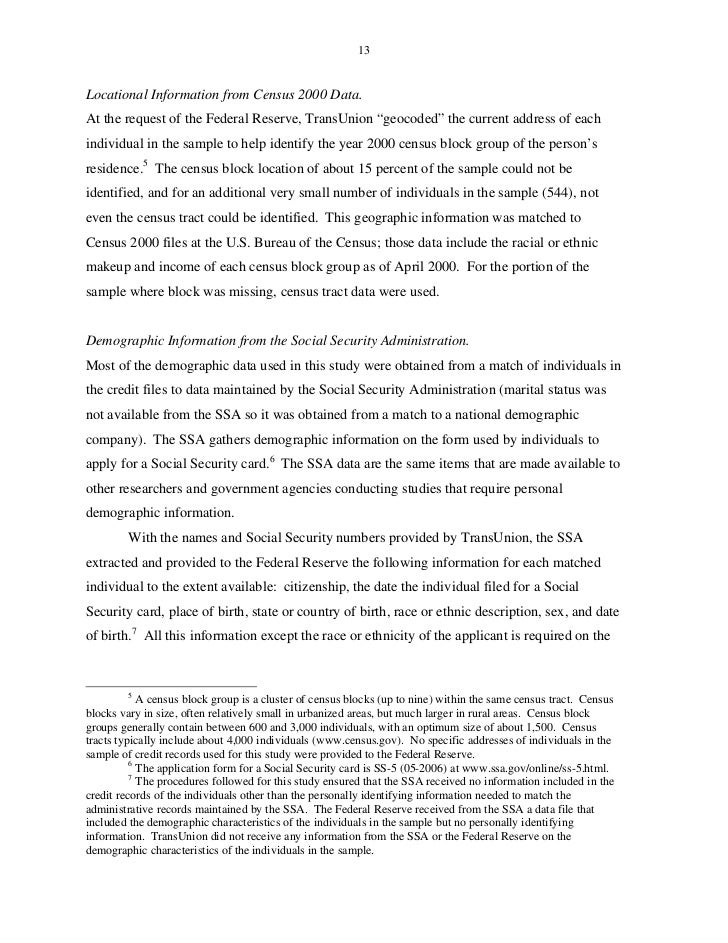

This picture demonstrates Logistic regression applications in finance.

This picture demonstrates Logistic regression applications in finance.

Google scholar

This image demonstrates Google scholar.

This image demonstrates Google scholar.

Scoring logistic regression

This picture representes Scoring logistic regression.

This picture representes Scoring logistic regression.

Logistic regression project report

This picture illustrates Logistic regression project report.

This picture illustrates Logistic regression project report.

Bayesian logistic regression models for credit scoring

This picture illustrates Bayesian logistic regression models for credit scoring.

This picture illustrates Bayesian logistic regression models for credit scoring.

How does the application of credit scoring work?

The application of credit scoring on consumer lending is an automated, objective and consistent tool which helps lenders to provide quick loan decisions. In order to apply for a loan, applicants must provide their attributes by filling out an application form.

How are credit scores used in the real world?

Credit scoring systems try to answer the question how likely an applicant for credit is to default within a certain period. The models use scores and ratios (called factors) of the clients that indicate the clients creditworthiness. There are many models available, currently the most commonly used is the logistic regression (LR) approach.

What is the ontology of the credit scoring model?

The ontology of the credit scoring model is illustrated in Figure 1. According to Figure 1, many loan applicants approach a bank to request loans, and these applicants are required to submit information such as age, gender, employment, residential status, number of dependents, etc. to the bank.

How is survival analysis used in credit scoring?

This model tries to estimate the number of defaults within a fixed time interval (typically 1 year). In the recent years survival analysis has been introduced into credit scoring. Survival analysis is the area of statistics that deals with the analysis of lifetime data. The variable of interest is the time to event.

Last Update: Oct 2021