Are you desperately looking for 'ipo research paper'? All material can be found on this website.

Table of contents

- Ipo research paper in 2021

- Initial public offering article

- A study on initial public offer (ipo in indian market)

- List of ipos by year

- Ipo analysis research paper

- Post and pre analysis of ipo

- Best ipo coming up

- Performance of ipo in indian stock market pdf

Ipo research paper in 2021

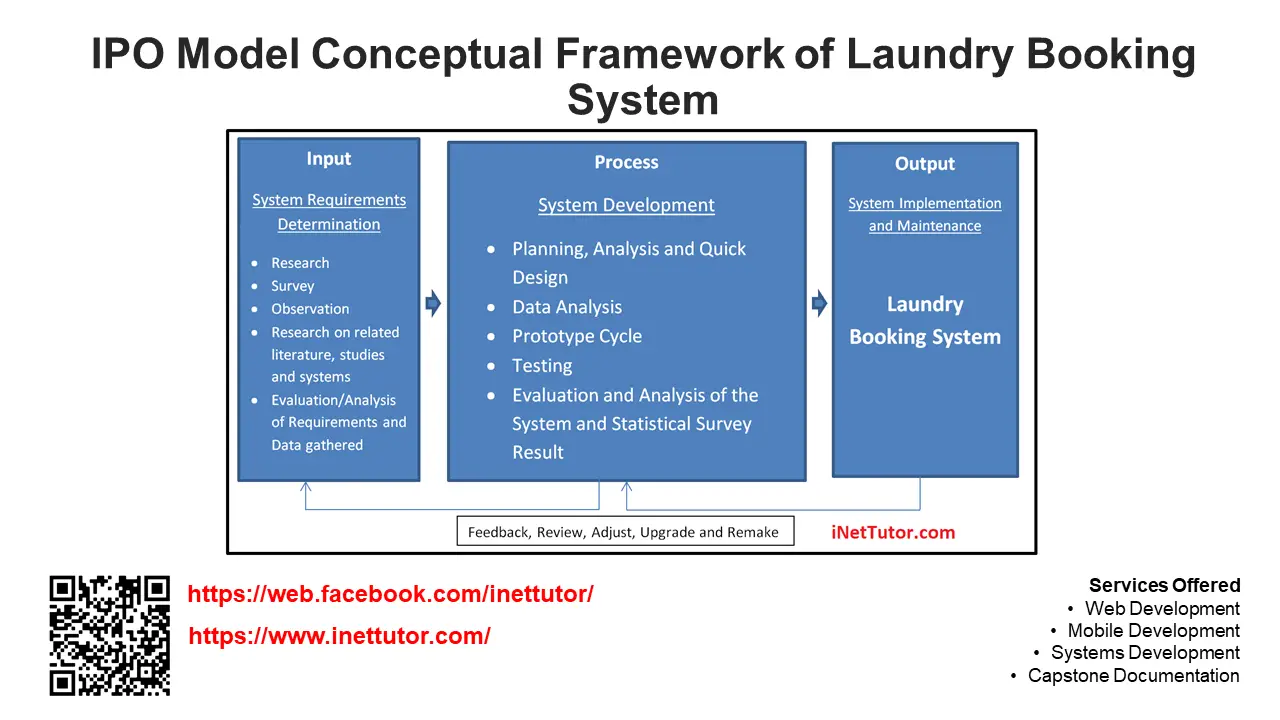

This image shows ipo research paper.

This image shows ipo research paper.

Initial public offering article

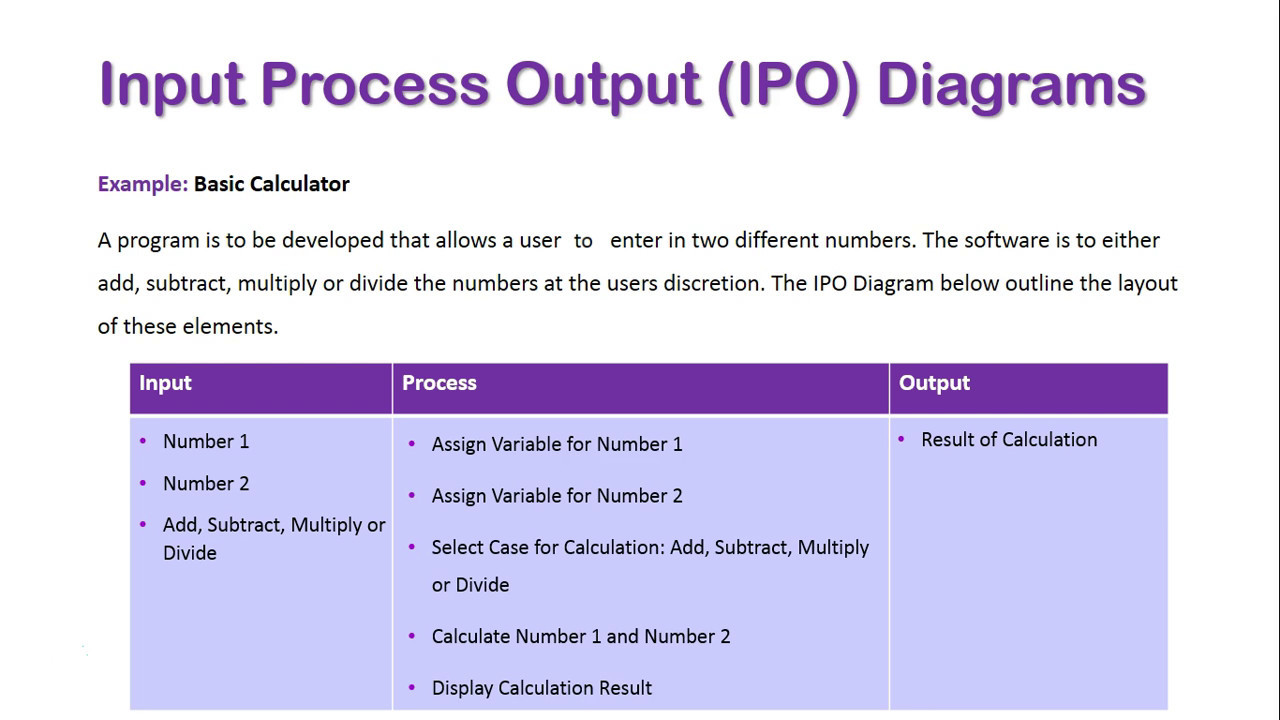

This picture demonstrates Initial public offering article.

This picture demonstrates Initial public offering article.

A study on initial public offer (ipo in indian market)

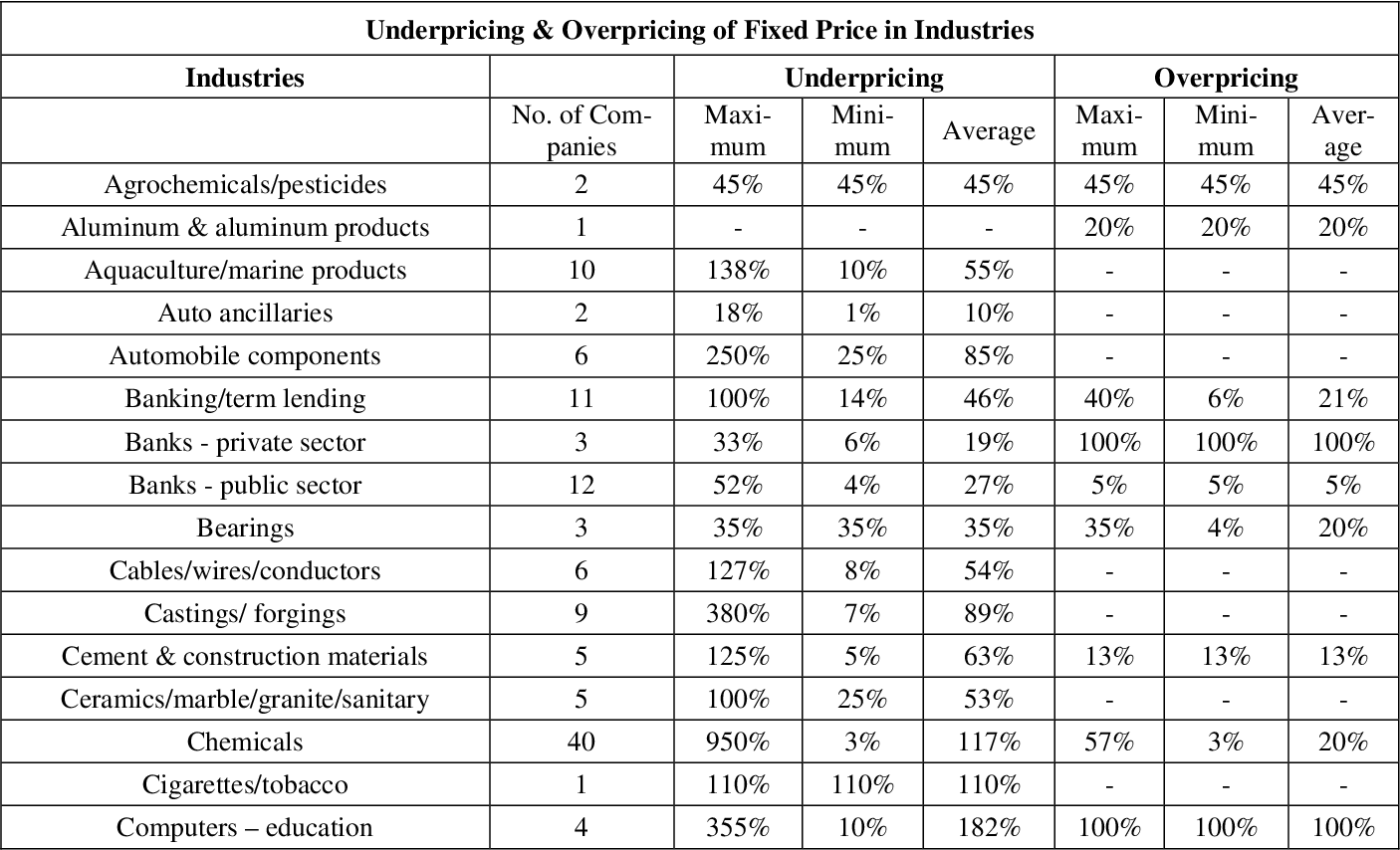

This picture demonstrates A study on initial public offer (ipo in indian market).

This picture demonstrates A study on initial public offer (ipo in indian market).

List of ipos by year

This image illustrates List of ipos by year.

This image illustrates List of ipos by year.

Ipo analysis research paper

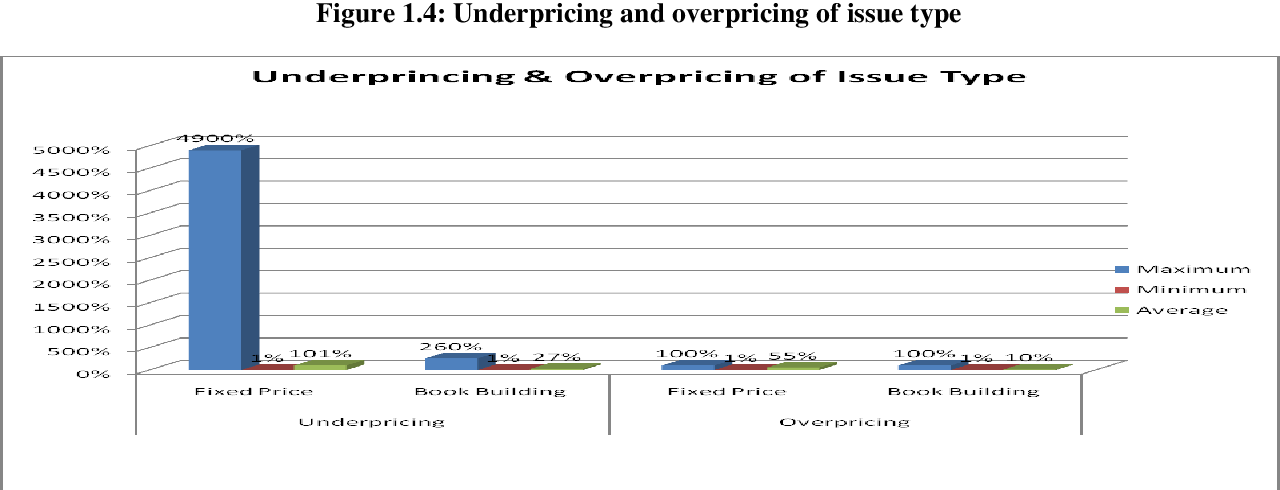

This image illustrates Ipo analysis research paper.

This image illustrates Ipo analysis research paper.

Post and pre analysis of ipo

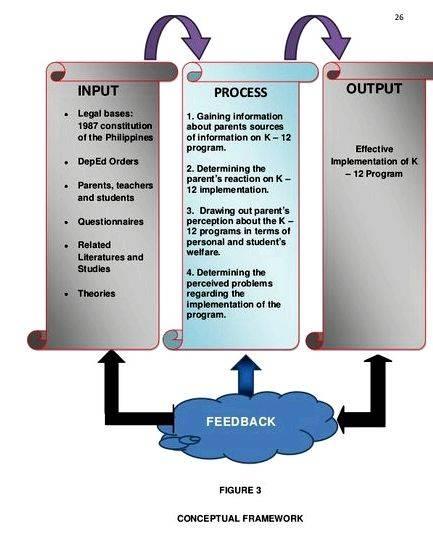

This image representes Post and pre analysis of ipo.

This image representes Post and pre analysis of ipo.

Best ipo coming up

This image demonstrates Best ipo coming up.

This image demonstrates Best ipo coming up.

Performance of ipo in indian stock market pdf

This picture demonstrates Performance of ipo in indian stock market pdf.

This picture demonstrates Performance of ipo in indian stock market pdf.

Who are the retail investors in IPOs in India?

A lot of money, in the tunes of crores of rupees is invested by the retail investors in the Indian capital market through IPOs. Involvement of Such a large sum of hard-earned money of investors and the participation of thousands of retail investors, pose a great case for study of performance of these IPOs.

Which is the best paper for IPO research?

ABSTRACT This paper uses a unique testing ground on the effect of price limits upon IPO pricing and initial returns. The Athens Stock Exchange offers the opportunity for this new experiment, as three substantial changes in limit regulations were implemented in a short period of eight years.

What do you need to know about the IPO?

IPO Research Paper. IPO (Initial Public Offering) is the first public share sale of a joint-stock company, including the sale in the form depositary receipts for shares, to the unlimited circle of persons. The sale of shares can occur both by placing of additional issue of equities via open subscription and by the public sale of issued shares.

How to measure the performance of IPOs in India?

We in this paper take IPOs issued in the year 2009, as a sample for assessing general performance of Indian IPOs. The concept of Wealth Relative (WR) and Market Adjusted Abnormal Rate of Return (MAAR) has been used to calculate short run and long run performance of the IPOs in India.

Last Update: Oct 2021